Representatives of the Federation of Veterinarians of Europe (FVE) have published a study titled Quo Vadis: Is Corporatisation Reshaping Companion Animal Veterinary Care in Europe? which analyses the impact of the growth of corporations in the veterinary practice across the continent.

A growing trend

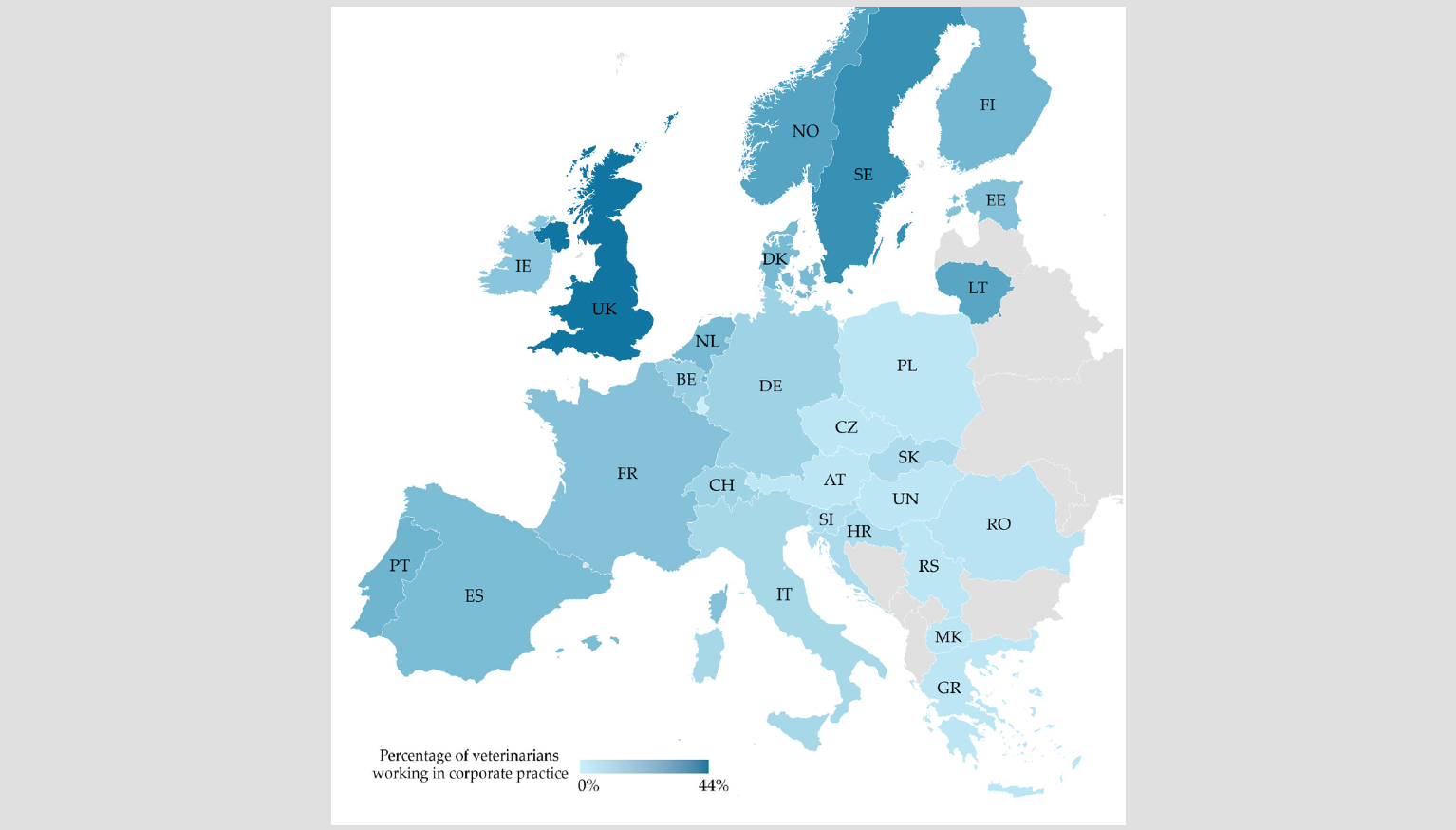

The report, published in Pets, examines the rapid evolution of the veterinary market in Europe, where independent clinics are being bought by large corporate groups. An overview of so-called corporate veterinarians in Europe is presented, drawing on the results of the VetSurvey 2023 and communications from its member associations. 16% of European veterinarians currently work in group-owned structures, with a particularly strong presence in the United Kingdom and Scandinavia (see map).

Young people are attracted to the model

Some countries are seeing their corporatisation rate explode, such as the UK (10% in 2013, 60% in 2024) and Croatia (15% in 2024). The VetSurvey shows that an increasing number of veterinarians are choosing salaried employment (36% in 2023 compared to 25% in 2015), while the status of owner-veterinarians is declining. And the trend is particularly present in young people, with 43% of corporate employees under 35. Millenials prioritise a good work-life balance and access to specialisation, the authors suggest, and consider corporates a more attractive business model than traditional independent practice.

Portfolio diversification

The rise in the number of pets, combined with rising expectations for care, is naturally attracting investors. Corporates are banking on rapid growth, portfolio diversification and market consolidation. This often involves acquisitions or mergers with companies in related sectors: laboratories, pharmaceutical companies, pet food manufacturers, crematoriums or retail chains (e.g. Dechra, Purina, Veternity, Zooplus).

Benefits and challenges

Corporate chains offer undeniable advantages: economies of scale, easy access to specialised equipment, administrative support, training and mentoring. But several challenges remain. The concentration of supply can reduce local competition. Rural areas or less profitable animal species (cattle, pigs) risk being neglected. Another source of tension: rising veterinary fees. Prices vary depending on the market. According to a Dutch study, massive acquisitions by private investors tend to drive up prices. Several marketing competition authorities, including those in the Netherlands and the United Kingdom, are currently investigating these developments.

Long-term implications

Finally, the article reiterates a fundamental principle: animal health and welfare must always be the priority, above commercial considerations. Veterinarians must demonstrate independence, impartiality and integrity in their practice. The European Veterinary Code of Conduct is clear on this point. Finally, the authors emphasise the importance of better understanding ownership structures in the veterinary sector. Greater transparency and analysis will help guide the profession toward sustainable solutions that reconcile economic profitability and respect for ethics.

The complete study is available here.

On the map: Percentage of veterinarians working in corporate practices by European country based on

responses to the 2023 VetSurvey.